How to finance your university education effectively is a question that weighs heavily on the minds of many prospective students and their families. The rising cost of higher education, coupled with the uncertainty of future job prospects, makes financial planning a critical component of the university journey.

From exploring scholarships and grants to understanding student loan options, navigating the financial landscape requires a strategic approach. This guide provides insights into the key steps involved in financing your university education effectively, empowering you to make informed decisions and minimize financial burden.

Understanding your financial situation is the first step. This involves creating a personal budget to track expenses and identify potential sources of income. You’ll need to calculate the total cost of your education, including tuition, living expenses, and other miscellaneous costs.

This comprehensive assessment will provide a clear picture of your financial needs and help you develop a tailored funding strategy.

Understanding Your Financial Situation

Before embarking on your university journey, it is crucial to assess your financial situation to create a realistic plan for funding your education. Understanding your current financial resources, potential income streams, and the overall cost of university will help you make informed decisions about financing your education.

Creating a Personal Budget and Tracking Expenses

A personal budget is a valuable tool for managing your finances and identifying areas where you can save money. By tracking your income and expenses, you can gain a clear understanding of your spending habits and make adjustments to allocate funds effectively.

To create a personal budget, you can follow these steps:

- List your income sources: This includes your salary, part-time jobs, scholarships, or any other regular income you receive.

- Track your expenses: Keep a record of all your spending, including necessities like rent, utilities, and groceries, as well as discretionary expenses like entertainment and dining out.

- Categorize your expenses: Group your expenses into different categories to analyze your spending patterns. For example, categorize your expenses into housing, transportation, food, entertainment, and personal care.

- Identify areas for savings: After reviewing your budget, identify areas where you can reduce your spending. This may involve cutting back on unnecessary expenses or finding cheaper alternatives for certain goods and services.

Tracking your expenses can be done manually using a spreadsheet or notebook or through budgeting apps that provide automated tracking and analysis features. By regularly reviewing your budget, you can identify areas for improvement and adjust your spending habits to meet your financial goals.

Identifying Potential Sources of Income

There are various ways to finance your university education, including scholarships, grants, student loans, and part-time jobs. Exploring these options and determining their suitability for your financial situation is crucial.

Scholarships and Grants

Scholarships and grants are forms of financial aid that do not need to be repaid. They are often awarded based on academic merit, financial need, or specific criteria set by the awarding organization. To find scholarships and grants, you can:

- Contact your university’s financial aid office: They can provide information about available scholarships and grants specific to your university and program of study.

- Search online databases: Websites like Scholarships.com, Fastweb, and Unigo offer comprehensive databases of scholarships and grants from various organizations.

- Check with professional organizations: If you are pursuing a specific field of study, consider contacting professional organizations in your industry for scholarships or grants tailored to their members.

- Reach out to your local community: Local businesses, community organizations, and religious institutions may offer scholarships or grants to students in the area.

Student Loans

Student loans are a common way to finance university education. They are borrowed funds that need to be repaid with interest after graduation. Types of student loans include:

- Federal student loans: These loans are offered by the U.S. Department of Education and typically have lower interest rates and more flexible repayment options compared to private loans.

- Private student loans: These loans are offered by private lenders, such as banks and credit unions. They may have higher interest rates and stricter eligibility requirements than federal loans.

When considering student loans, it is crucial to understand the terms and conditions, including the interest rate, repayment period, and any potential fees. It is advisable to explore different loan options and compare their terms to find the most favorable option.

Part-Time Jobs

Working part-time during your studies can be a helpful way to supplement your income and reduce your reliance on student loans. However, it is essential to balance your work schedule with your academic commitments to ensure you can maintain good academic performance.To find part-time jobs, you can:

- Contact your university’s career services office: They often have job postings for on-campus positions and may provide assistance with resume writing and interview preparation.

- Search online job boards: Websites like Indeed, Monster, and CareerBuilder offer a wide range of part-time job postings in various industries.

- Network with your peers and professors: They may have leads on part-time jobs that align with your skills and interests.

- Explore freelance opportunities: If you have specific skills or talents, you can consider freelancing as a way to earn extra income.

Calculating the Total Cost of University Education

To accurately assess your financial needs, it is essential to calculate the total cost of your university education. This includes tuition fees, living expenses, and other miscellaneous costs.

Tuition Fees

Tuition fees are the primary cost associated with university education. They vary depending on the institution, program of study, and whether you are an in-state or out-of-state student.To determine your tuition fees, you can:

- Visit the university’s website: Most universities provide detailed information about their tuition fees on their websites.

- Contact the admissions office: They can provide you with an accurate estimate of your tuition fees based on your chosen program of study.

Living Expenses

Living expenses include costs associated with housing, food, transportation, and personal expenses. These costs vary depending on your location, lifestyle, and whether you live on or off campus.To estimate your living expenses, you can:

- Research the cost of living in your chosen city or town: Websites like Numbeo and Expatistan provide cost of living comparisons for different locations.

- Contact the university’s housing office: They can provide information about on-campus housing costs and off-campus rental rates in the surrounding area.

- Consider your individual needs and preferences: Factor in your personal expenses, such as food, transportation, and entertainment, based on your lifestyle and spending habits.

Miscellaneous Costs

In addition to tuition and living expenses, there may be other miscellaneous costs associated with university education, such as:

- Books and supplies: You will need to budget for textbooks, course materials, and other supplies required for your program of study.

- Fees: Universities may charge various fees, such as application fees, technology fees, and student activity fees.

- Health insurance: Some universities require students to have health insurance, which may be included in tuition fees or require separate payment.

- Personal expenses: This includes costs for clothing, toiletries, entertainment, and other personal needs.

The total cost of university education can be calculated using the following formula:Total Cost = Tuition Fees + Living Expenses + Miscellaneous Costs

By carefully calculating the total cost of your university education, you can create a realistic financial plan and explore financing options that align with your budget.

Exploring Funding Options

Securing funding for your university education is a crucial step. Numerous options exist beyond personal savings and family contributions. This section delves into various avenues for financial assistance, including scholarships, grants, and student loans.

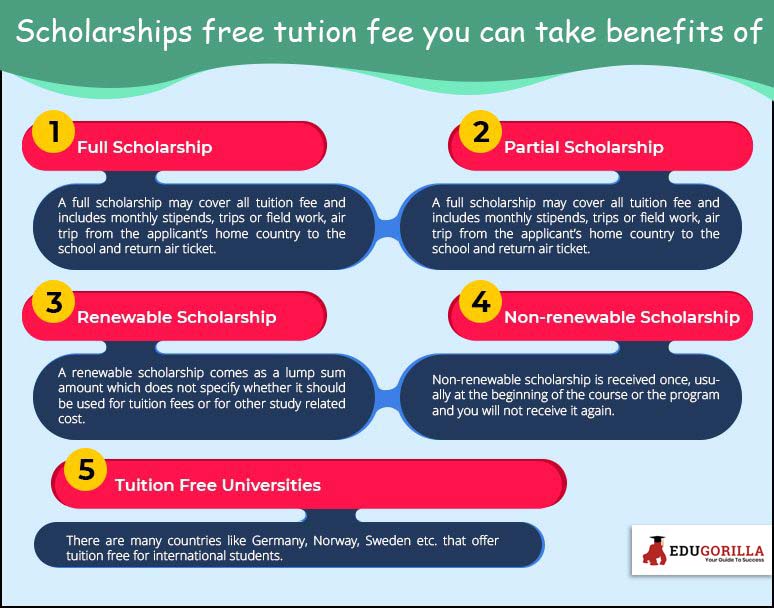

Scholarships and Grants

Scholarships and grants are forms of financial aid that do not require repayment. They are awarded based on academic merit, financial need, or a combination of both.

Types of Scholarships and Grants

- Merit-Based Scholarships: Awarded based on academic achievements, extracurricular activities, or specific skills. These scholarships recognize outstanding students and their contributions.

- Need-Based Grants: Awarded to students demonstrating financial hardship. These grants help make education accessible to those facing financial challenges.

- Federal Grants: Grants offered by the U.S. Department of Education, such as the Pell Grant, are need-based and do not require repayment. These grants are a significant source of financial assistance for many students.

- State Grants: Grants offered by individual states, often with specific eligibility requirements, such as residency or academic performance. These grants can provide additional financial support for students.

- Private Scholarships: Offered by organizations, corporations, or individuals. These scholarships often have specific criteria, such as academic focus, heritage, or community involvement.

Application Process for Scholarships and Grants

- Research Opportunities: Thoroughly research available scholarships and grants that align with your academic background, interests, and financial needs. Online platforms, university financial aid offices, and scholarship search engines can be valuable resources.

- Meet Eligibility Requirements: Carefully review the eligibility criteria for each scholarship or grant, including GPA, major, or specific achievements. Ensure you meet the necessary qualifications before applying.

- Prepare Application Materials: Gather all required documents, such as transcripts, letters of recommendation, essays, and financial information. Pay close attention to deadlines and submission instructions.

- Complete Applications with Care: Dedicate time to complete applications thoroughly and accurately. Proofread all materials before submitting.

Student Loans

Student loans provide temporary financial assistance to cover education expenses. They require repayment with interest after graduation.

Types of Student Loans

- Federal Student Loans: Offered by the U.S. Department of Education, these loans typically have lower interest rates and more flexible repayment options compared to private loans. Federal loans also offer benefits like income-driven repayment plans and loan forgiveness programs.

- Private Student Loans: Offered by banks, credit unions, or other private lenders. Interest rates and repayment terms for private loans can vary significantly, depending on the lender and the borrower’s creditworthiness.

Key Considerations for Student Loans

- Interest Rates: The interest rate determines the amount of interest you will pay on your loan. Lower interest rates translate to lower overall borrowing costs.

- Repayment Terms: The repayment term refers to the duration of the loan. Longer repayment terms can lower monthly payments but result in higher overall interest costs.

- Eligibility Criteria: Lenders have specific eligibility criteria, such as credit score, income, and enrollment status. Ensure you meet the requirements before applying.

Planning for University Expenses

A comprehensive understanding of university expenses is essential for effective financial planning. This section provides insights into budgeting, saving, and expense reduction strategies to help you navigate the financial landscape of higher education.

Budgeting for University Expenses

A well-structured budget is crucial for managing university finances effectively. The following sample budget categorizes common university expenses:

| Expense Category | Estimated Cost (USD) |

|---|---|

| Tuition and Fees | $10,000

|

| Housing | $5,000

|

| Food | $2,000

|

| Transportation | $1,000

|

| Books and Supplies | $1,000

|

| Personal Expenses | $1,000

|

This sample budget provides a general framework; actual costs may vary depending on the university, location, and individual spending habits.

Saving for University Education

Saving for university education requires a strategic approach, considering the time remaining before enrollment.

“Time is your most valuable asset when saving for university.”

Here’s a timeline for saving, assuming enrollment in four years:

- Year 1:Begin saving regularly, aiming for a significant portion of the estimated annual cost.

- Year 2:Increase savings contributions to build a substantial fund.

- Year 3:Focus on maximizing savings and exploring potential investment opportunities.

- Year 4:Finalize savings and secure necessary financial resources for enrollment.

This timeline provides a general framework; individual circumstances may necessitate adjustments.

Strategies for Reducing University Expenses

Minimizing university expenses can significantly impact overall costs. The following strategies offer practical solutions:

- Explore Affordable Housing Options:Consider off-campus housing, shared apartments, or living with family to reduce housing costs.

- Minimize Unnecessary Spending:Identify areas where spending can be reduced, such as entertainment, dining out, and non-essential purchases.

- Utilize Student Discounts:Take advantage of student discounts offered by various businesses and organizations.

- Seek Financial Aid and Scholarships:Explore federal, state, and institutional financial aid programs, as well as scholarships.

- Consider Part-Time Employment:Working part-time during university can help offset expenses and gain valuable work experience.

Maximizing Financial Aid Opportunities: How To Finance Your University Education Effectively

Financial aid can significantly reduce the cost of your university education. It comes in various forms, including grants, scholarships, loans, and work-study programs. Understanding how to maximize your financial aid opportunities is crucial for making your education more affordable.

The Role of the Free Application for Federal Student Aid (FAFSA)

The Free Application for Federal Student Aid (FAFSA) is the primary application for federal financial aid, including grants, loans, and work-study programs. Completing the FAFSA accurately and on time is essential to maximize your eligibility for federal aid. The FAFSA determines your Expected Family Contribution (EFC), which is the amount you and your family are expected to contribute toward your education.

Your EFC, along with the cost of attendance at the school you are attending, determines your financial aid eligibility.

Completing the FAFSA

- File the FAFSA Early:The FAFSA is available online at fafsa.gov starting October 1st each year. Filing early ensures you receive the maximum amount of financial aid available, as some programs have limited funding and are awarded on a first-come, first-served basis.

- Gather Necessary Information:Before you begin filling out the FAFSA, gather all the necessary information, including your Social Security number, driver’s license, and tax information for both you and your parents (if applicable). This will help ensure the accuracy of your application.

- Review Your FAFSA Carefully:Double-check your application for any errors before submitting it. Errors can lead to delays in processing your application and potentially reduce your eligibility for financial aid.

- Update Your FAFSA If Necessary:Your financial situation may change throughout the year. If you experience a significant change in income or other circumstances, update your FAFSA to reflect these changes.

Applying for Institutional Financial Aid Programs

Universities also offer various financial aid programs in addition to federal aid. These programs are often funded by the university itself and may be based on academic merit, financial need, or other criteria.

- Contact the Financial Aid Office:The best way to learn about institutional financial aid programs is to contact the financial aid office at the university you are attending. They can provide you with information about the specific programs available, eligibility requirements, and application deadlines.

- Explore Scholarships:Universities often have a wide range of scholarships available to students. These scholarships can be based on academic merit, athletic ability, extracurricular activities, or other criteria.

- Apply for Work-Study:Work-study programs allow you to earn money while attending school. These programs can be a valuable way to help cover your education expenses and gain work experience.

Managing Student Loans

Student loans can be a valuable tool for financing your education, but it’s crucial to understand the terms and conditions of your loans to avoid financial hardship. Managing your student loan debt effectively requires careful planning and responsible borrowing practices.

Understanding Student Loan Terms and Conditions, How to finance your university education effectively

Before taking out student loans, it’s essential to understand the terms and conditions, including the interest rate, repayment options, and any fees associated with the loan. * Interest Rates:The interest rate determines how much you’ll pay in interest over the life of the loan.

Lower interest rates are generally more favorable.

Repayment Options

Repayment options can vary depending on the type of loan and lender. Common options include:

Standard Repayment

Fixed monthly payments over a set period, typically 10 years.

Graduated Repayment

Payments start low and gradually increase over time.

Income-Driven Repayment

Monthly payments are based on your income and family size.

Fees

Some student loans may have origination fees or other charges.

Strategies for Managing Student Loan Debt

Once you’ve taken out student loans, it’s essential to develop a strategy for managing your debt effectively.* Prioritize Repayment:Prioritize paying off loans with the highest interest rates first.

Explore Consolidation Options

Consolidating multiple loans into one may lower your monthly payment and simplify repayment.

Consider Refinancing

Refinancing your loans may offer a lower interest rate, but it’s crucial to carefully compare terms and fees.

Make Extra Payments

Even small extra payments can significantly reduce the amount of interest you pay over time.

Use Automatic Payments

Setting up automatic payments can help you avoid late fees and stay on track with your repayment schedule.

Potential Consequences of Defaulting on Student Loans

Defaulting on your student loans can have severe consequences, including:* Damage to Your Credit Score:Defaulting on a loan will negatively impact your credit score, making it more difficult to obtain future loans or credit cards.

Wage Garnishment

The government can garnish your wages to collect on defaulted student loans.

Tax Refunds and Social Security Benefits

The government can seize your tax refunds and Social Security benefits to pay off defaulted loans.

Difficulty Obtaining Government Jobs

Defaulting on student loans can make it difficult to obtain government jobs or security clearances.

Responsible Borrowing Practices

Borrowing responsibly is crucial for avoiding financial hardship and managing your student loan debt effectively.* Borrow Only What You Need:Avoid borrowing more than you need to cover your education expenses.

Shop Around for Loans

Compare interest rates and terms from different lenders to find the best deal.

Understand the Terms and Conditions

Thoroughly review the loan terms before signing any documents.

Create a Repayment Plan

Develop a plan for repaying your loans before you graduate.

Prioritize Financial Literacy

Educate yourself about personal finance and debt management to make informed decisions about borrowing and repayment.

Financial Planning for the Future

The journey to financial stability doesn’t end with graduation. In fact, it’s just the beginning. As you transition into the professional world, it’s crucial to develop sound financial habits that will set you up for long-term success. This section will explore key aspects of financial planning, focusing on building a solid credit history, managing your finances effectively, and understanding the importance of financial literacy.

Establishing Good Credit and Building a Positive Credit History

Credit plays a vital role in your financial life. A good credit score opens doors to lower interest rates on loans, better credit card terms, and even favorable rental agreements. Building a positive credit history starts early and involves responsible financial practices.

- Start Early:Begin establishing credit by applying for a secured credit card, which requires a security deposit, or becoming an authorized user on a parent’s or family member’s credit card. This helps build your credit history and demonstrates responsible credit usage.

- Pay Bills on Time:Making timely payments on all your bills, including rent, utilities, and credit card payments, is crucial for a good credit score. Late payments negatively impact your credit history, so set reminders and prioritize paying bills on time.

- Use Credit Wisely:Avoid maxing out your credit cards and aim to keep your credit utilization ratio (the amount of credit you use compared to your available credit limit) below 30%. A lower ratio indicates responsible credit management.

- Monitor Your Credit Report:Regularly check your credit report for errors and ensure its accuracy. You can obtain a free credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) annually at AnnualCreditReport.com.

Managing Finances After Graduation

After graduation, you’ll likely be responsible for managing your own finances. This involves budgeting, saving, and potentially investing to achieve your financial goals.

Securing funding for your university education is a crucial step, and a strong application can significantly improve your chances of receiving scholarships or financial aid. To make your application stand out, leverage the Best resources for university application preparation available, including online guides, workshops, and expert advice.

With a well-crafted application, you can increase your likelihood of accessing the financial support needed to pursue your academic goals.

- Create a Budget:Track your income and expenses to understand where your money is going. Budgeting tools and apps can help you track spending and identify areas where you can save.

- Establish an Emergency Fund:Aim to save 3-6 months’ worth of living expenses in an emergency fund to cover unexpected events, such as job loss or medical emergencies. This financial cushion provides peace of mind and helps you avoid going into debt during unexpected situations.

- Save for Retirement:Start saving for retirement early, even if it’s just a small amount. Take advantage of employer-sponsored retirement plans, such as 401(k)s, and contribute regularly. The power of compounding returns can significantly grow your savings over time.

- Consider Investing:Investing in stocks, bonds, or mutual funds can help your money grow faster than simply keeping it in a savings account. However, investing involves risk, so it’s essential to research and understand the risks involved before investing.

Financial Literacy and Long-Term Financial Stability

Financial literacy, the ability to understand and manage your finances effectively, is crucial for achieving long-term financial stability.

- Seek Financial Education:Take advantage of online resources, workshops, and seminars to enhance your financial knowledge. Understanding concepts like budgeting, saving, investing, and debt management empowers you to make informed financial decisions.

- Set Realistic Financial Goals:Define your financial goals, such as buying a home, starting a business, or retiring comfortably. Having clear goals provides direction and motivation to make sound financial decisions that align with your aspirations.

- Seek Professional Advice:Consider consulting a financial advisor for personalized guidance, especially when making significant financial decisions like investing or planning for retirement. A financial advisor can provide objective advice based on your individual circumstances and goals.

End of Discussion

Financing your university education effectively requires a proactive approach that involves exploring various funding options, planning for expenses, maximizing financial aid opportunities, and managing student loans responsibly. By understanding your financial situation, exploring scholarships and grants, creating a budget, and seeking financial aid, you can navigate the complexities of higher education financing and pave the way for a successful academic journey.

Remember, financial literacy plays a crucial role in achieving long-term financial stability, so make it a priority to educate yourself on the best practices for managing your finances after graduation.

Essential Questionnaire

What if I don’t qualify for enough financial aid?

If you don’t qualify for enough financial aid, consider exploring alternative funding options such as private loans, crowdfunding, or working part-time. It’s also important to prioritize your expenses and explore ways to reduce costs, such as choosing affordable housing options and minimizing unnecessary spending.

How can I improve my chances of getting a scholarship?

To improve your chances of getting a scholarship, focus on achieving high academic performance, engaging in extracurricular activities, and demonstrating leadership skills. Research scholarship opportunities that align with your interests and academic goals, and submit well-written applications that highlight your achievements and potential.

What are some tips for managing student loan debt?

To manage student loan debt effectively, prioritize repayment, explore consolidation options, and consider income-driven repayment plans. It’s also essential to avoid defaulting on your loans by making timely payments and communicating with your lender if you face financial difficulties.