Best investment options for high schoolers with limited income – Navigating the world of investing can feel daunting, especially for high schoolers with limited income. However, starting early with smart choices can set the stage for a secure financial future. This guide explores practical investment options tailored for young individuals, emphasizing the importance of saving, education, and building positive financial habits.

While the idea of investing might seem intimidating, it’s a powerful tool for achieving long-term financial goals. By understanding the basics of investing, exploring different options, and developing sound financial practices, high schoolers can start building wealth and securing their financial future.

This guide provides practical insights and strategies to help young individuals embark on their investment journey, even with limited resources.

Understanding Financial Basics

Saving and investing are crucial aspects of financial planning, especially for high schoolers who are just starting their financial journeys. These habits can set the foundation for a secure future, allowing you to achieve your financial goals, whether it’s buying a car, paying for college, or simply building a safety net.

Importance of Saving and Investing

Saving and investing are essential for high schoolers because they help build a financial foundation for the future. Saving allows you to accumulate funds for short-term goals, like buying a new phone or taking a trip, while investing allows you to grow your money over the long term.

This growth can help you achieve larger financial goals, like buying a house or retiring comfortably.

Types of Investments

Investing can seem intimidating, but it’s not as complicated as you might think. There are various investment options available, each with its own level of risk and potential return. Here are a few examples:

- Stocks: Stocks represent ownership in a company. When you buy stock, you become a shareholder and have a claim on the company’s profits. Stocks can offer high returns, but they are also volatile, meaning their value can fluctuate significantly.

- Bonds: Bonds are loans that you make to a company or government. In return for lending your money, you receive interest payments. Bonds are generally considered less risky than stocks, but they also offer lower returns.

- Mutual Funds: Mutual funds pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. This diversification can help reduce risk.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds, but they are traded on stock exchanges like individual stocks. They offer diversification and can be bought and sold throughout the day.

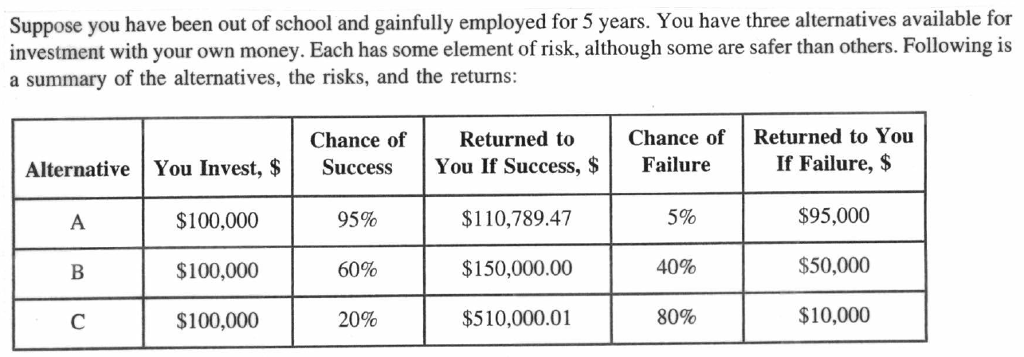

Risk and Return in Investing

Investing always involves some level of risk, but the higher the risk, the greater the potential return. This concept is known as the “risk-return trade-off.” For example, stocks are considered riskier than bonds, but they also have the potential to generate higher returns.

“The higher the risk, the higher the potential return, and vice versa.”

Understanding the risk-return trade-off is crucial for making informed investment decisions. You should always choose investments that align with your risk tolerance and financial goals.

Investing with Limited Income

Investing with limited income can seem daunting, especially for high schoolers. However, even small amounts can grow over time, setting you up for a brighter financial future. There are several accessible investment options that can work for you, and with some smart saving strategies, you can build a solid foundation for your financial journey.

Common Investment Options for High Schoolers

There are several investment options suitable for high schoolers with limited income.

- Micro-investing platforms:These platforms allow you to invest small amounts of money, often as little as $1 or $5. They are designed for beginners and offer a user-friendly interface.

- Robo-advisors:Robo-advisors use algorithms to create and manage investment portfolios based on your risk tolerance and financial goals.

They are often more affordable than traditional financial advisors.

- High-yield savings accounts:These accounts offer higher interest rates than traditional savings accounts, allowing your money to grow faster.

- Peer-to-peer lending:This allows you to lend money to borrowers through online platforms, earning interest payments.

- Index funds:Index funds track a specific market index, such as the S&P 500, offering diversification and lower fees than actively managed mutual funds.

Saving Money Effectively

Saving money effectively is crucial for investing, especially when starting with limited income.

- Create a budget:Track your income and expenses to identify areas where you can cut back.

- Automate savings:Set up automatic transfers from your checking account to your savings account.

- Look for discounts and deals:Take advantage of student discounts, coupons, and other savings opportunities.

- Reduce unnecessary expenses:Consider cutting back on entertainment, dining out, or other non-essential expenses.

- Earn extra income:Find part-time jobs, freelance gigs, or other ways to supplement your income.

Micro-investing Platforms

Micro-investing platforms offer a convenient way to invest small amounts of money regularly.

- Benefits:

- Accessibility:These platforms allow you to invest with small amounts, making investing more accessible for those with limited income.

- Convenience:They are easy to use and often offer mobile apps for convenient investing.

- Diversification:Micro-investing platforms often allow you to invest in a variety of asset classes, such as stocks, bonds, and real estate.

- Drawbacks:

- Limited control:You may have less control over your investment decisions compared to traditional brokerage accounts.

- Fees:Micro-investing platforms may charge fees, which can eat into your returns.

- Limited investment options:They may not offer the same range of investment options as traditional brokerage accounts.

Educational Investments

Investing in education and skills development is crucial for high schoolers, especially those with limited income. It empowers them to acquire valuable knowledge and skills, leading to better job opportunities and financial stability in the long run. This investment can be a powerful tool for breaking the cycle of poverty and achieving personal and professional goals.

Free and Low-Cost Educational Resources

Free and low-cost educational resources can provide high schoolers with valuable knowledge and skills without straining their budgets. These resources can include:

- Online Courses:Platforms like Coursera, edX, and Khan Academy offer free or affordable courses on a wide range of subjects, from programming to business to humanities. These platforms provide a flexible learning environment, allowing students to learn at their own pace and from the comfort of their homes.

- Local Libraries:Public libraries offer a wealth of free resources, including books, e-books, audiobooks, and access to computers and internet. Many libraries also host free workshops and events on various topics, providing opportunities for skills development and personal growth.

- Community Colleges:Community colleges often offer affordable tuition and flexible schedules, making them an accessible option for high schoolers seeking to acquire vocational skills or pursue further education.

Potential Return on Investment for Education

Investing in education can lead to significant returns in the long run, including:

- Higher Earning Potential:Individuals with higher levels of education generally earn more than those with less education. A study by the U.S. Bureau of Labor Statistics found that workers with a bachelor’s degree earned an average of $1.2 million more over their lifetime than those with only a high school diploma.

- Increased Job Security:In a rapidly evolving job market, education and skills development can enhance job security. Individuals with specialized skills and knowledge are more likely to adapt to changing job demands and remain competitive in the workforce.

- Personal Growth and Fulfillment:Education can foster personal growth and fulfillment, broadening horizons, expanding knowledge, and developing critical thinking skills. Investing in education can lead to a more enriching and satisfying life.

Building Good Financial Habits: Best Investment Options For High Schoolers With Limited Income

Developing good financial habits early in life can set you up for a secure and prosperous future. These habits will serve you well as you navigate the complexities of managing your finances, even with limited income as a high school student.

Creating a Simple Budget Plan

A budget is a plan for how you will spend your money. It helps you track your income and expenses and make sure you are not spending more than you earn. Here is a simple budget plan for high schoolers:

- Track your income:This includes any money you earn from a job, allowance, or gifts. It’s important to know how much money you have coming in.

- List your expenses:These are the things you spend money on, such as food, transportation, entertainment, and clothes.

- Categorize your expenses:Once you have listed your expenses, categorize them into different groups, such as necessities, wants, and savings.

- Compare income and expenses:Subtract your total expenses from your total income to see if you have a surplus or a deficit.

- Adjust your spending:If you have a deficit, you need to find ways to reduce your expenses or increase your income. If you have a surplus, you can use the extra money to save for your future or to invest.

Managing Debt and Avoiding Unnecessary Expenses

Debt is money you owe to someone else. It can be a big burden, especially if you are not careful about how you manage it. Here are some tips for managing debt and avoiding unnecessary expenses:

- Avoid using credit cards:Credit cards can be tempting, but they can also lead to debt if you are not careful. If you must use a credit card, only use it for emergencies and pay it off in full each month.

- Be mindful of your spending:Before you buy something, ask yourself if you really need it. If you can wait to buy it, do so. This gives you time to consider if you truly need the item or if it’s an impulse purchase.

- Shop around for the best deals:Don’t settle for the first price you see. Compare prices at different stores and online before you buy anything.

- Take advantage of discounts and sales:Look for coupons, rebates, and sales before you buy anything.

- Avoid impulse purchases:These are purchases you make without thinking about them. They can add up quickly and put you in debt.

The Importance of Financial Literacy

Financial literacy is the ability to understand and manage your finances. It is essential for everyone, but it is especially important for high schoolers who are just starting to learn about money. Here are some of the benefits of financial literacy:

- Helps you make informed financial decisions:Financial literacy gives you the knowledge and skills you need to make sound financial decisions, such as choosing the right investments, managing your debt, and planning for your future.

- Improves your financial well-being:Financial literacy can help you avoid financial mistakes and achieve your financial goals.

- Increases your earning potential:Financial literacy can help you make more money by helping you invest wisely and manage your finances effectively.

- Reduces your stress levels:Financial stress can be a major burden. Financial literacy can help you manage your finances effectively, which can reduce your stress levels.

Seeking Guidance and Support

Navigating the world of investing can be overwhelming, especially for young people with limited experience. Thankfully, there are numerous resources and individuals available to provide guidance and support, helping you make informed decisions and achieve your financial goals.

While investing in the stock market might seem like a distant dream for high schoolers with limited income, there are still smart ways to invest in your future. One crucial investment is in the tools that will help you succeed in your studies.

A good laptop or tablet can be a game-changer, but choosing the right one can be overwhelming. How to choose the right student gadget for your needs provides helpful tips to make the best decision. Investing in a reliable gadget can be a valuable asset for your academic journey and set you up for future success.

Resources and Organizations

Accessing reliable information and support is crucial for successful investing. Here are some organizations and platforms that cater to young investors:

- The National Endowment for Financial Education (NEFE):NEFE offers a wide range of resources, including educational materials, workshops, and online tools, specifically designed for young adults. They provide valuable insights into personal finance, investing, and money management.

- The JumpStart Coalition for Personal Financial Literacy:JumpStart is a non-profit organization dedicated to promoting financial literacy among young people. They offer resources, programs, and advocacy initiatives to empower youth to make sound financial decisions.

- The Financial Industry Regulatory Authority (FINRA):FINRA is a non-profit organization that regulates the securities industry. They provide educational materials and resources on investing, including a dedicated website for young investors called “Investor.gov.”

- Local Libraries and Community Centers:Many libraries and community centers offer free financial literacy programs and workshops. These resources can provide valuable insights into investing and personal finance, tailored to your local needs.

Consulting with a Financial Advisor or Mentor, Best investment options for high schoolers with limited income

While online resources are helpful, seeking personalized guidance from a financial advisor or mentor can be invaluable.

- Financial Advisors:A financial advisor can provide tailored investment advice based on your individual circumstances, risk tolerance, and financial goals. They can help you create a diversified investment portfolio, manage your investments, and navigate the complexities of the financial market.

- Mentors:A mentor can provide valuable guidance and support based on their personal experience and expertise. They can offer insights into the investment process, share their strategies, and help you avoid common pitfalls.

Online Platforms and Communities

The internet offers a wealth of information and resources for young investors. Several online platforms and communities foster learning and engagement:

- Investopedia:Investopedia is a popular website that provides comprehensive information on investing, personal finance, and financial markets. It offers educational articles, videos, and tools for beginners and experienced investors alike.

- Reddit’s r/investing:This subreddit is a vibrant community where investors of all levels share their knowledge, discuss investment strategies, and provide support. It’s a great place to learn from experienced investors and get insights into current market trends.

- YouTube Channels:Numerous YouTube channels offer educational content on investing and personal finance. Some popular channels include “The Financial Diet,” “The School of Greatness,” and “Financial Education.”

- Online Courses:Platforms like Coursera, edX, and Udemy offer online courses on investing and personal finance. These courses provide structured learning opportunities and can help you develop a deeper understanding of financial concepts.

Last Point

Investing early, even with limited income, can make a significant difference in your long-term financial well-being. By prioritizing saving, investing in your education, and cultivating good financial habits, you can build a strong foundation for financial success. Remember to seek guidance from trusted resources and mentors to make informed decisions that align with your individual goals and risk tolerance.

Embrace the journey of financial empowerment and start investing in your future today.

Questions Often Asked

What are some good micro-investing platforms for high schoolers?

Popular micro-investing platforms like Acorns, Stash, and Robinhood offer options for young investors. These platforms allow you to invest small amounts regularly, making them accessible even with limited income. However, it’s crucial to research and compare platforms to find one that aligns with your investment goals and risk tolerance.

How can I get started with investing if I don’t have much money?

Start by setting a realistic budget and identifying any potential sources of extra income. Consider part-time jobs, online gigs, or selling unused items. Even small amounts saved consistently can add up over time. Additionally, explore micro-investing platforms or consider opening a Roth IRA, which allows you to invest after-tax dollars and potentially withdraw your earnings tax-free in retirement.

Is it safe to invest in the stock market as a high schooler?

Investing in the stock market can be risky, but it can also offer significant potential returns. It’s essential to understand the risks involved and only invest money you can afford to lose. Start with a small amount and diversify your investments across different asset classes to mitigate risk.

Consider seeking guidance from a financial advisor or mentor for personalized advice.